Textbook Solution Manuals

Get Step-by-step Solutions As fast as in 30 Minutes

Struggling with textbook solutions? Getting Tough or Difficult textbook question? We have all the textbook that you need! Get step-by-step textbook solutions by our experts.

Add College Textbook

Add Your College Textbooks in just 20 Seconds!

You can now add your college textbooks and request our experts to solve them for you. And it involves very simple steps! Just create your account, login to your dashboard and add the textbooks instantly!

* Add Unlimited College textbooks and Get Solutions in no time!

Check Out the Latest College Textbook Solution Curated by Our Experts

Question posted by Student

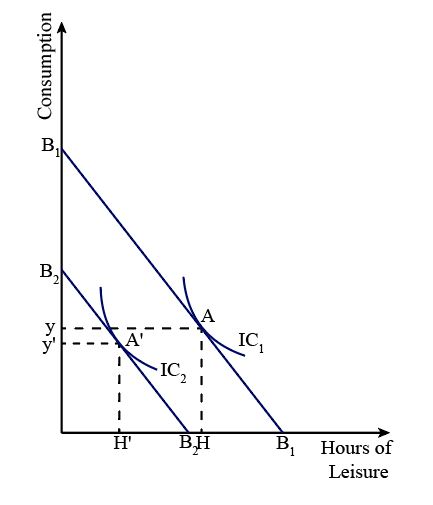

Show on a graph the impact of the reduction in the non-labor income on the hours of work.Answer by our PHD Expert

There is a drop in the non-labor income; as a consequence, the budget line will shift inward from B1 to B2, and the indifference curve will go too from IC1 to IC2. This reduction in non-labor income will reduce the leisure hours as well as the time working; if the income effect is in dominance. However, if we consider the substitution effect is in dominance, then this reduction in the non-labor income would lead to a rise in the hours working and falling of leisure demands, and this is shown by movement from point H to H' and work from y to y'.

How it works?

Want to know how to search your homework answers on Crazy for Study? We are here to give you the answer!

- 1

- 2

- 3

Get an instant Answer

Ask an Experts

Get Answer in 30 min

Get access to 24/7 Homework Help

Unlimited access to solved homework questions

Ask 50 new homework questions to experts

Unlimited access to textbook solution

Textbook Solutions Manual by Crazy for Study

Crazy for Study is a platform curated in a way that supports the students in every possible way. We provide services like writing help, assignment solutions, textbooks solutions, ask questions from our experts, also you can apply for the scholarship. And one of our best services is providing solutions manuals for textbooks at cheaper rates.

Details About Our Textbook Solutions Manual

At Crazy for Study, we understand the importance of understanding the solutions to textbook questions. Our experts have years of teaching experience and use a student-friendly approach to write solution manuals for textbooks. This means that the solutions are written in an easy-to-understand language and come with step-by-step explanations.

As a college student, you are expected to understand the subjects covered in your textbook. However, there may be times when you struggle to comprehend a particular topic or question. This is where our platform comes in handy. Crazy for Study provides comprehensive and affordable Online textbook solutions for college textbook questions.

As the name suggests, textbook solutions are the textbook solution manuals to the textbook questions. Our solution manual for college textbooks is written in a very easy-to-understand language. With the help of our textbooks' solution manuals, you can understand step-by-step solutions to any problem. The easy-to-understand language is because our experts use a student-friendly approach to write the textbook solutions for college stations

We have always believed in assisting students at every stage of their education with our textbook solutions website. And when most of the lessons learned in the classroom are done through textbooks, the Online textbook solutions manuals are quite important. This is the reason we have launched the Crazy for Study platform. Based on the requirements or problems students face, we were inspired to curate some of the major features of our services, which are as follows:

Get Access to Unlimited Textbook Solutions Manual:

Whether it’s history, geography, physics, chemistry, mathematics, biology, or any other, we have textbook solutions manuals for millions of college textbooks across every category. You name it, we have it, and even if by any chance we don’t have textbook solutions for the questions you asked, we have a team of experts who can curate an answer for every question you have and will ease down the difficult problems.

Do you want solutions to your college textbook? Enroll with us now and get access to unlimited textbook solutions manuals.

Get Access to Unlimited 5000+ Ph.D. Experts for any Customized Textbook Solutions.

Our Ph.D. experts have so much experience teaching students that the answers are written in the simplest way possible. Even the solution is curated in a step-by-step manner to make the student understand what is happening in every step.

If you're having trouble and can't find a solution to a textbook question, contact our Ph.D. experts for personalized assistance. We have experts in every field; you choose whom you want to write the answer for your college textbooks.

With our platform “Crazy for Study”, a textbook solutions website, you get access to unlimited textbook problem solutions. Whether it’s history, geography, physics, chemistry, mathematics, biology, or any other subject, we have a solution manual for millions of college textbooks across every category. Our platform also provides you with access to 5000+ Ph.D. experts who can provide customized solutions to any questions you may have.

Facing an issue and couldn’t find an answer to your problem, enroll with us now and ask the experts directly.

Get Support Availability 24*7

We know how difficult it is to submit the assignment on time when you are unaware of the solutions to the textbook questions. As a result, we are always available to you because all we care about is resolving the real pain of students, which is the assignments or solution manual for textbooks wherever you are having difficulties.

In addition to having access to unlimited textbook solutions, you also get 24/7 support. Our platform is designed to help you overcome the challenges you face in submitting assignments on time. Our experts are always available to help you with any questions you may have, no matter what time it is.

So, get in touch with us now and get yourself covered with our services.

Get Accurate Textbook Solutions Only at $6.5.

Finally, our platform offers accurate textbook solutions for just $6.5. We believe that every student deserves access to quality solutions, regardless of their financial background. This is why we offer our solution manuals at an extremely cheap price, which is even lower than the cost of a burger.

With our help, we guarantee you better grades at a lower cost. Quite affordable, isn't it? Enroll yourself and get your textbook problem solutions now.

Conclusion

In conclusion, if you are looking for an easy, comprehensive, and affordable solution manual for textbooks for your college textbook questions, Crazy for Study is the platform for you. With our platform, you can get step-by-step explanations and expert guidance to help you understand your textbook questions better. Sign up today and get started on your journey to better grades.

Why choose our online assignment services?

We at Crazy for Study know that you must first master your textbooks to ace your exams. We also know that answering every question isn't easy. So our list of readers includes every book that may be included in a specific course curriculum. It also has a variety of reference materials.